How Accurate are Mortgage Calculators?

Buying a home is a significant financial decision, and accurately estimating mortgage payments is crucial to ensuring affordability and financial stability. Mortgage calculators have become an essential tool in this process, offering a quick and convenient way to estimate monthly payments and assess various mortgage options. However, understanding their accuracy and using them effectively requires some insights.

How accurate are mortgage payment calculators?

Mortgage calculators provide general estimates based on the information you input, such as loan amount, interest rate, and loan term. While they offer a close approximation, keep in mind that actual payments may vary based on factors like taxes, insurance and interest rates. It's advisable to monitor interest rate trends and adjust your estimates accordingly. In addition, some mortgage calculators may not account for certain variables, like special mortgage programs. It's essential to consult with a lender to gain a comprehensive understanding of all potential costs associated with your mortgage.

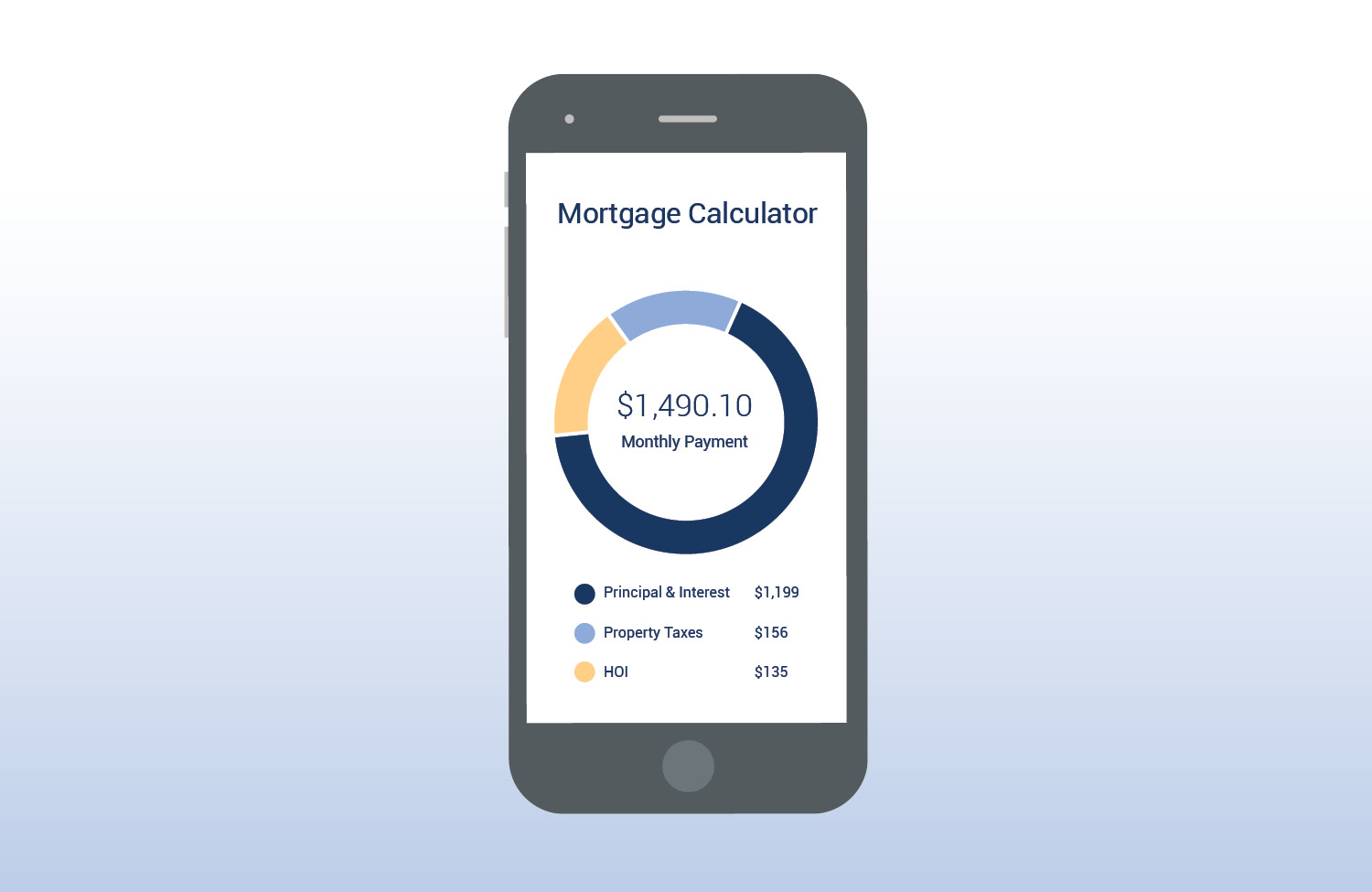

Our mortgage calculator tool:

Our calculator tool helps your better understand your budget and home eligibility by giving you an estimated monthly payment based on purchase price, current loan rates, and loan terms. For those considering refinancing*, we also provide a refinance calculator to better understand how a refinance could impact your current mortgage.

Let’s take a closer look at the features of our monthly mortgage payment calculator:

Best practices for using mortgage calculators:

Here are some tips for getting the best results from our mortgage calculator tool…

*NOTE: Refinancing an existing loan may result in finance charges being higher over the life of the loan. Reduction of payments may reflect a longer term.

How accurate are mortgage payment calculators?

Mortgage calculators provide general estimates based on the information you input, such as loan amount, interest rate, and loan term. While they offer a close approximation, keep in mind that actual payments may vary based on factors like taxes, insurance and interest rates. It's advisable to monitor interest rate trends and adjust your estimates accordingly. In addition, some mortgage calculators may not account for certain variables, like special mortgage programs. It's essential to consult with a lender to gain a comprehensive understanding of all potential costs associated with your mortgage.

Our mortgage calculator tool:

Our calculator tool helps your better understand your budget and home eligibility by giving you an estimated monthly payment based on purchase price, current loan rates, and loan terms. For those considering refinancing*, we also provide a refinance calculator to better understand how a refinance could impact your current mortgage.

Let’s take a closer look at the features of our monthly mortgage payment calculator:

- Loan type: Select the desired loan type.

- Home price: The selling price of the desired property.

- Down payment: The percentage of your home’s purchase price that you’d like to pay upfront. Our calculator tool will automatically set this amount to 20%, but that can easily be adjusted.

- Did you know? A 20% down payment is not required to purchase a home and we offer zero to low down payment loan options, as well as down payment assistance programs for eligible buyers. For example: Conventional Loans start at 3% down, FHA Loans start at 3.5% down, and VA Loans start at zero down for qualified buyers. Ask your loan officer for more information!

- Interest rate: This is the interest rate your banking establishment charges for use of their assets. Keep in mind, actual available rates and monthly payment amounts are subject to market fluctuations and will depend on a number of factors, including geography and loan characteristics.

- Loan term: The number of years it will take to pay off the loan fully.

- Principal & Interest: Principal is the total amount you’ve borrowed from your lender to buy a home. Interest is the fee lenders charge you for borrowing their money; usually, an annual percentage rate.

- Property taxes: This includes any tax on real estate.

- Homeowners Insurance (HOI): Financial protection that you purchase from an insurance provider. HOI helps pay for losses if a covered disaster or other damaging event affects your home.

- Homeowners Association (HOA) Dues: A monthly or quarterly fee assessed by the HOA to pay for the services that it provides. Not all properties have an HOA, but it is an important cost to consider.

- Private Mortgage Insurance (PMI): Insurance policy that compensates lenders for losses from a mortgage loan default. Some loan types require private mortgage insurance regardless of down payment amount.

Best practices for using mortgage calculators:

Here are some tips for getting the best results from our mortgage calculator tool…

- Gather Accurate Information: To obtain the most precise estimates, input accurate information into the calculator. This includes the loan amount, interest rate, loan term, down payment, and potential additional costs like property taxes and insurance.

- Explore Loan Scenarios: Mortgage calculators enable you to experiment with different loan scenarios, such as adjusting the down payment or loan term. This can help you assess how these changes impact your monthly payments and overall costs.

- Stay Informed: Keep yourself informed about current interest rates, as they play a significant role in your mortgage payments. By staying updated, you can adjust your calculations as needed.

- Consult Professionals: While mortgage calculators are useful tools, consulting with your lender is highly recommended. Our team of loan officers can provide personalized advice, explain any nuances in your mortgage terms, and ensure you're making an informed decision.

*NOTE: Refinancing an existing loan may result in finance charges being higher over the life of the loan. Reduction of payments may reflect a longer term.